Gavias Blockbuider URLA Resources

Redesigned URLA Required for all New Applications - March 2021

As of March 1, 2021, all new applications will automatically default to the redesigned URLA. The URLA Type data point in the worksheet will allow specification of the version of the URLA received: Revised2009 or Effective2021. Worksheets which do not indicate an URLA type will default to the Redeisgned URLA based on the application date.

DocMagic Milestones:

- March 2021 - the Redesigned URLA becomes the default loan application version in DocMagic

- February 2021 - DocMagic releases updated Redesigned URLA for faster processing times (avg 2.07 sec)

- August 2020 - First client use in production of the Redesigned URLA

- April 2020 - DocMagic Online updated to include January 2020 revisions for Redesigned URLA

- February 2020 - Redesigned URLA with January 2020 revisions available for testing

- June 2019 - DocMagic releases revised DocMagic Online interface to support new data fields for the Redesigned URLA

- April 2019 - DocMagic hosts Redesigned URLA Webinar

- February 2019 - DocMagic users are able to test the new URLA forms

- February 2019 - DocMagic's Chief Compliance Officer and Richard Horn provide URLA Webinar through October Research

- January 2019 - DocMagic completes data mapping in support of MISMO data conveyance, published to all integration partners

- November 2018 - DocMagic begins updates to DocMagic Online screens (DMO) in support of new URLA fields

- August 2018 - DocMagic completes data analysis and updated application design

- June 2018 - DocMagic completes gap analysis of supported data fields/additions to new URLA

- December 2017 - DocMagic adds new content and dynamic layout features present on the redesigned URLA

- August 2017 - DocMagic completes layout of the redesigned URLA

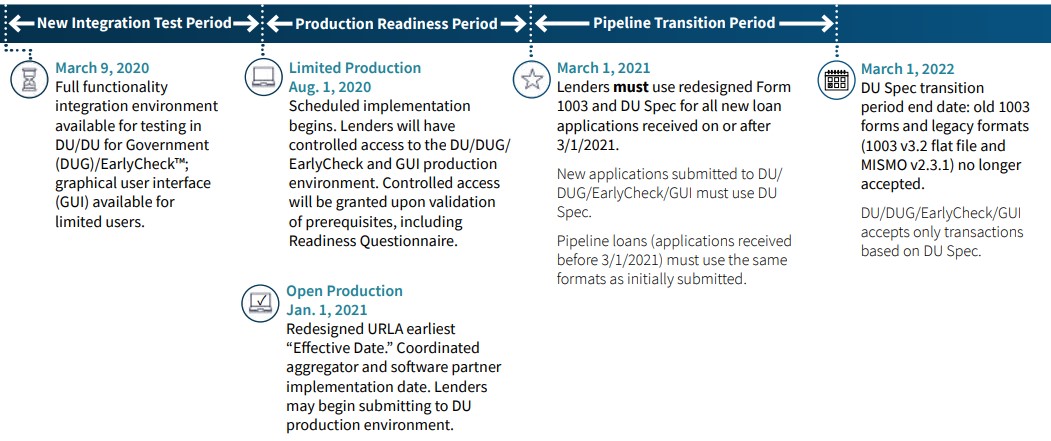

Fannie Mae Revised Timeline

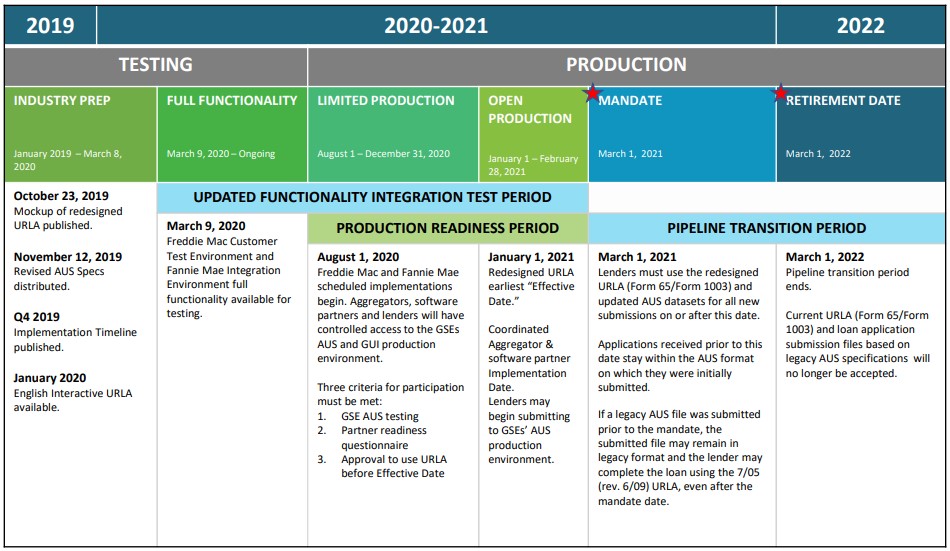

Freddie Mac Revised Timeline

Links and Resources

Form 1003 Samples (click and download)

Additional Resources/Articles

- DocMagic "Understanding the URLA" Webinar Recording

- DocMagic "Understanding the URLA: Part 2" Webinar Recording

- Fannie Mae Video Explanation

- Fannie Mae - old vs. new comparison (excel download)

- Fannie Mae URLA Learning Center

- Freddie Mac URLA and ULAD Business Resources

Newsletter Articles

- The New URLA: The No. 1 Thing To Do ASAP To Ensure You're Ready (Feb 2021)

- GSEs Release Joint Statement Regarding the Revised URLA (December 2020)

- Updated Spanish Translation Aids for Redesigned URLA (November 2020)

- New Interactive Spanish Translation Aids for Redesigned URLA (October 2020)

- GSEs Publish Updated Interacitve Spanish Translation Aids for Redesigned URLA (June 2020)

- GSEs Announce Extension to Implementation Timeline for Redesigned URLA (April 2020)

- Update on Status of Transition to Redesigned Uniform Residential Loan Application (Feb. 2020)

- GSEs Announce New Implementation Timeline for Revised URLA (Dec. 2019)

- GSEs Announce Publication of Update to Redesigned URLA (Oct. 2019)

- GSEs Announce Postponement of Revised URLA Mandatory Use Date (Aug. 2019)

- Revised URLA Delayed (June 2019)

- DocMagic Announces Support for the Redesigned Uniform Residential Loan Application (Feb. 2019)

- Redesigned URLA & Preferred Language Question (Dec. 2017)

- Wizard: New Form: Demographic Information Addendum Article (Feb. 2017)

- DM Plans for Implementing the Revised URLA, and Demographic Addendum (Oct. 2016)

- The URLA Gets a Facelift (Sept. 2016)

- Fannie Mae and Freddie Mac Release Redesigned URLA/Form 1003 (Aug. 2016)

The Redesigned URLA

The URLA has been updated to include some new (and removing some old) information borrowers must furnish in the application process, in the aim of providing greater clarity and easier use during this time.

The URLA accomplishes this by organizing information borrowers must provide, acknowledge, and agree to, compared to information the lender must collect and verify during processing and underwriting of the loan.

In addition, the GSEs have updated sections of the URLA to help lenders increase turn-around times by capturing more complete application information from borrowers by bolstering certain areas of the application such as income verification, military service, assets and liabilities, and more in depth property information.

And remember to prepare by:

- Identifying any data you do not currently collect

- Subscribe to DocMagic's mailing list

- Check DocMagic's website for updates

Compliance Edge Premium Subscription

The Compliance Edge, DocMagic’s premium subscription resource, offers the most up-to-date compliance information available from legal analysis to the latest mortgage industry news. The latest mortgage industry laws and regulations are organized into actionable information designed to help you stay on top of compliance. The Compliance Edge is a powerful resource that Premium Subscribers rely on to reduce compliance risk, lower costs and increase operational efficiencies.

The right services

We can help you to transform your processes through the implementation and management of smart solutions, apps, and technology.